Content

The denominator is calculated by summing the number of countries that import each product that Country A exports. It is the share of exports sold in each foreign country in the home country’s total exports. When you trade from the short side, not only do you have players who want to buy at support levels, you also have players who want to close their short positions.

Whichever indexing strategy you use, it will take time and effort to construct the right portfolio. It will also require a significant amount of transaction costs, as you will need to buy, for instance, 500 individual stock orders to capture the S&P 500. Commissions, in such a case, can really add up making it very costly to do. CFDs are a financial derivative, which means you can use them to speculate on indices that are rising in value, as well as falling.

Verlander, who is 3-4 with a 3.60 E.R.A., missed the first month of the season with a back injury. Scherzer was suspended for 10 games for violating baseball’s rules against using foreign substances on the ball. While he has 26 home runs, his on-base plus slugging percentage is down some 50 points from 2022.

Stock markets just go up easy than they go down, and at the end of the day, the job of a trader is to take the line of least resistance – which is usually up. DAX 30 index is one of the most commonly traded indicators in the world, because the DAX30 trend is easy to notice, making it the most popular trading market. The best indicator for synthetic indices will always be having a solid understanding of trading fundamentals, which all come together in market structure trading. In actuality, there are no best indications for synthetic indices; if there were, then most traders would be profitable. Unlike the FX market, which is impacted by major central banks and the world’s events? With the exclusion of fundamental news, synthetic indices are specially created to replicate the real-world market.

“It’s on us if we want to keep this thing afloat,” Max Scherzer, the veteran right-handed starting pitcher, said in San Diego before the Mets scattered for the All-Star break. In 2001, China joined the World Trade Organization, a group that grants members preferential tariffs when trading with one another. That access opened the door to China to become a leading trade and manufacturing hub, as the Dallas Fed pointed out. In that same stretch, however, US exports to China climbed from $48.8 billion to $49.3 billion. Some ROTC scholarships cover full tuition, provide additional money for books, and come with a monthly living allowance. You will have to commit to serve as an officer for a specified number of years after graduation, though, so make sure you’re willing to undertake such an obligation.

Discover everything you need to know about stock indices, including how to trade them and which markets are available to you. CFDs are complex financial instruments and come with a high risk of losing money rapidly due to leverage. Traders who make a plan (and stick to it) will be more likely to see consistent profits. A disciplined approach to trading indices will help you avoid emotional-based decisions based on impulse or fear.

Know the difference between spread bets, CFDs and futures

The Good Money Guide is a UK-based guide to trading, investment and currency accounts. We offer expert reviews, comparison, news, analysis, interviews and guides so you can choose the best provider for your needs. The Financial Times Stock Exchange 100 Index (abbreviated FTSE 100) tracks the top 100 companies listed on the London Stock Exchange. The index is market cap weighted, hence it is composed of many large established names like Unilever, BP and HSBC.

- You can close the trade to lock in potential profits, or to limit losses if the trade isn’t going as you predicted.

- For example, the NASDAQ 100 lists the biggest non-financial companies listed on the NASDAQ stock exchange.

- This allows you to buy the market, on the whole, essentially getting a “piece of the companies” that make up the greater index.

- Hedging is the method of opening a position that offsets potential losses in one or more existing trades.

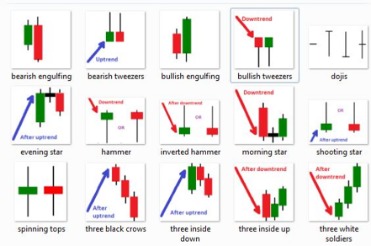

Bear in mind the benefits of technical analysis tools such as chart patterns and moving averages when choosing your potential entry and exit points. It may be useful to research practices and approaches and read up on the market or sector in question. Aside from cash indices, futures and options, you can also trade index ETFs and individual shares with us.

What is the best time to trade indices?

Unless the contract is unwound before the expiration through an offsetting trade, the trader is obligated to deliver the cash value on the expiry. Cash indices are favoured by traders with a short-term outlook – such as day traders – because they have tighter spreads than index futures. Cash indices are traded at the spot price – which is the current price of the underlying market. You can speculate on the price of indices rising or falling without taking ownership of the underlying asset with CFDs.

An index is essentially an imaginary portfolio of securities representing a particular market or a portion of it. When most people talk about how well the market is doing, they https://g-markets.net/helpful-articles/how-to-identify-supply-and-demand-zones/ are referring to an index. In the United States, some popular indexes are the Standard & Poor’s 500 Index (S&P 500), the Nasdaq and the Dow Jones Industrial Average (DJIA).

Costs of trading

Going long means that you are speculating on the value of a future increasing, and going short means that you are speculating on its value decreasing. You can also enhance your trading by learning how to analyse price charts by using oscillators and other technical indicators. Follow macroeconomic data that can have an impact on the index, as well as government policy announcements, and keep an eye on major geopolitical events that can drive markets higher or lower. You can trade directly with your CFD broker for stock index trading rather than using an exchange or mutual fund provider. If you are interested in learning how to trade indices, there are three main ways traders could gain index exposure in their portfolios.

Price-weighted indices are less common than those based on market cap. The Dow Jones Industrial Average (US30) in the US and Nikkei 225 are both price-weighted indices. PrimeXBT allows traders to benefit from crypto movement, as deposits are done in Bitcoin.

Choose how to trade indices

The Dow Jones Industrial Average features a lot of household names that most people would recognize. Managed healthcare, insurance, information technology, pharmaceutical industry, financial services, and many other sectors are covered in this index. As a general rule, if a stock is roughly 5% of the daily volume from the index, it should then be calculated as 5% of the overall price of the same index. On the other hand, if the stock is at the bottom of the list as far as volume is concerned, it will contribute much less.

- You ll find the trading platform simple and intuitive with fast execution.

- This ratio can be used to assess changing world market share of a country over time.

- PrimeXBT Trading Services LLC is incorporated in St. Vincent and the Grenadines as an operating subsidiary within the PrimeXBT group of companies.

As an aside, Forbes calculated that LVMH’s owner Bernard Arnault is the second richest man in the world with a net worth exceeding $100 billion. It derives its value from 30 major stocks on the Frankfurt Stock Exchange and is seen as a broad indicator of the German economy. Because of its small number of components, DAX can be more volatile compared to the FTSE 100 or the S&P 500 index. Proprietary trading firms are transforming day trading, offering higher capital, lower risk, and community support—a compelling shift from traditional retail brokers. Discover how these changes could revolutionize your trading strategy.

The FTSE 100 is the most popular equity index in the UK due to its representativeness and liquidity. From the Nasdaq 100 Index, there is this exchange-traded fund called QQQ (cube). Discover the 4 common mistakes traders make when setting stop loss orders. Learn how to avoid them for effective risk management and profitable trading. In this article, we’ll delve deeper into the workings of prop firms, and how they can serve as a beneficial platform for both budding and established traders.

Cash indices are traded at the spot price of the index, which is the current price of the underlying market. Because they have tighter spreads than index futures, they’re favoured by day traders with a short-term outlook. We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Forex trading

Index trading can also pose a lower risk than foreign exchange (forex) trading. In the forex markets, traders speculate on currency pairs – aiming to profit from the rise or fall in the value of one currency against another with the risk of loss if the trade moves against them. Every one of the world’s major financial markets has at least one stock index to represent it. For example, the S&P 500 (US500) is an index of the 500 largest companies in the US. As these benchmark indices often reflect the performance of the overall stock market, movement in the benchmark’s value indicates the health of the economy or industry sector it tracks.

No actual stocks are bought or sold; index options are always cash-settled, and are typically European-style options. Going long means you are buying a market because you expect the price to rise. Going short means you are selling a market because you expect the price to fall. If you plan on holding on to an index position for a long time, trading index futures will mean that you don’t incur frequent overnight funding charges. A primary advantage of trading indices using derivatives like spread bets and CFDs is the sheer breadth of market exposure accessed in a single position. The Dow Jones Industrial Average is one of the oldest indices around (1896).

Futures are typically used to express either an opinion on further moves or a way to hedge exposure. If you have a specific part of your portfolio that you are looking to hedge, then it makes the most sense to trade in the opposite direction on the index of the industry, sector, or country in question. This allows you to buy the market, on the whole, essentially getting a “piece of the companies” that make up the greater index. By using a long position, the trader is betting on the market going higher, which is much simpler than looking for individual winners. Most of the time, there are certain companies in an index that have more influence on the market, based on the volume of trading.

As they are traded on exchanges, the price of these funds fluctuates throughout the trading session, unlike a mutual fund for which the price is settled once daily. ETFs can be bought and sold quickly and easily through stock trading platforms. The leverage offered at PrimeXBT is also higher than many of our competitors, allowing traders to benefit from movement in the market. By offering such leverage, successful traders can profit immensely from this benefit. It covers 30 prominent companies listed on stock exchanges in the United States, and unlike many of its other peers, it does not use a weighted average.